How does Germany have the 2nd largest trade surplus in the world? And other questions in global economics.

Understanding Germany’s trade dominance is not easy. The topic is fraught with tough political questions, some of which are hotly debated today (if not necessarily by academics, certainly by politicians). Indeed, words like “trade surplus” and “trade deficit” have a lot of baggage even when they don’t explicitly denote positive or negative things in terms of overall wellbeing, economic or otherwise.

It may not be the final word on these subjects, but Conrad Bastable wrote an informative and holistic tour of domestic economic policy and international trade in an article on his site called The Germany Shock: The Largest Economy Nobody Understands. It is of course mostly focused on Germany, but some of the most interesting lessons are about China. I must confess I am not totally sure I understand everything involved here, but it provides a thorough look at a lot of topics that are glossed over in most other readings and establishes a pretty solid foundation for understanding these issues as they come up in the future.

The whole article is a must read (and maybe make that two or three reads before it all falls into place), but there are a few things that really stand out and are worth shining a light on.

Exchange rates are a Cheat Code for selling stuff — you might not be willing to cheat, but China is.

China is widely accused of currency manipulation in order to keep its currency cheap. The mechanics of intentional deflation seem pretty understandable — just print more money and the currency will be less valuable — but this isn’t the whole story. According to Bastable, an important factor in the Yuan devaluation is its relative value. China purchases and holds foreign currency like USD, which puts upward pressure on the value of those currencies. The Yuan is pegged to the dollar and thus loses value as USD goes up.

The Euro & the Single Market make it possible for Germany to pursue a strategy of Export-driven Wealth-creation that would be considered impossible in any other Western, high-GDP, high-population, high-wage-paying nation.

The European Union is a novel experiment, and the Euro (equally novel) is an incredibly important factor in the region’s development. Germany benefits from downward pressure on the Euro from poorer countries in the EU, and the single market provides a wellspring of seamless demand (buy things from Germany or from the U.S. with a big VAT on top of the goods). Not discussed is the liability of debt laden countries and other sovereign crises, but so far the Euro and European Central Bank have weathered those storms, if at the very least in terms of currency value.

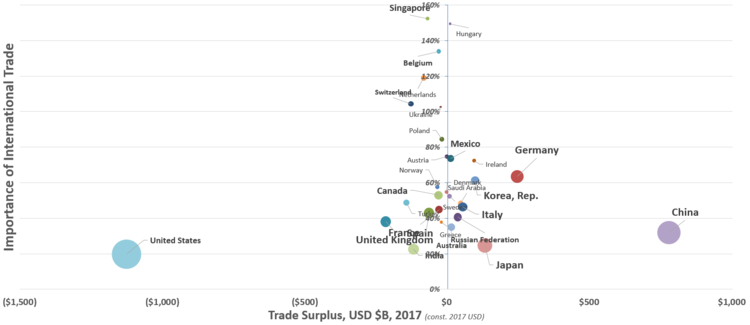

Germany runs the second largest Trade Surplus in the world, at $250 Billion in Surplus on $1.3 Trillion of Exports. Germany earns 7% of its GDP from that Surplus — only the tiny nations of Ireland and Hungary produce more of their GDP directly from Trade. For a large, developed nation, this is quite odd…

…and it should be somewhat surprising given common Narratives that “cost of labor” is a big driver of industrial capacity reallocation away from Western nations.

Despite having a workforce with a high median income, Germany is able to find an extremely demanding market for goods and service produced by workers that earn those wages. The explanations for why labor is outsourced to other countries is always more complicated than it seems, but it’s taken as a given that low cost of labor is the key. The ongoing success of German exports complicates that logic.

There is so much in Bastable’s article, much more than is covered here, and it really is a must read. It will build a much deeper understanding of so many of the economic questions and challenges we face in an increasingly globalized economy, so check it out here!